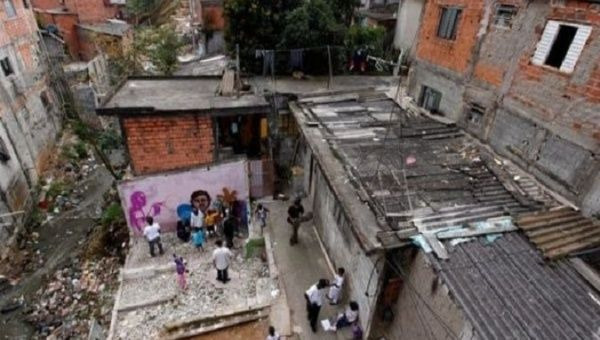

Other elements pointed out by ECLAC focus on sustaining the welfare of the poorest sectors. | Photo: La Jornada

Santiago de Chile, June 7 (RHC)-- According to parameters such as the slow growth of the economy and the rise of inflation, poverty and extreme poverty will increase in the Latin American and Caribbean region, according to the latest projections made on Monday by the Economic Commission for Latin America and the Caribbean (ECLAC).

Through an evaluative report on economic growth in the region, ECLAC stressed that "taking into account the effects of slow growth and accelerating inflation, poverty and extreme poverty are expected to rise above estimated levels by 2021".

According to the economic body, the incidence of regional poverty would reach 33.7 percent, which would represent 1.6 percentage points higher than projected for 2021, and extreme poverty would reach 1.1 percent more than in 2021, which is equivalent to 14.9 percent.

Due to the rise in #inflation, especially in food, by 2022 we foresee an increase in #poverty to 33% and extreme poverty to 14.5%: @RolandoOcampoA, Director of the Statistics Division of #CEPAL.

"The economies of Latin America and the Caribbean began to experience an increase in the inflation rate in 2021. While at the close of 2021, annual inflation in the region reached 6.6 percent, that rate increased to 8.1 percent in April 2022, while many central banks anticipate that inflation will remain high in the remainder of the year," the official note of the report's presentation noted.

The regional bloc also pointed out that this result reflects the strong increase in food prices, which are higher than those observed before the Covid-19 pandemic and also directly intervene in the fight against poverty.

For ECLAC, the solution to this juncture is to "continue using fiscal policy as a central element of development policy, which requires strengthening public revenues to expand fiscal space."

On the other hand, "it is necessary to reduce evasion, redirect tax expenditures and strengthen the progressiveness of the tax structure. To contain inflationary pressures, it is necessary to combine the use of the monetary policy rate with macro prudential and exchange rate instruments, in order to address inflation while minimizing the negative effects on growth and investment."