State budget. Image: Cubadebate

Havana, February 9 (RHC)-- In difficult times for the Cuban economy, all analysts' eyes are now focused on the potential to solve problems, hence the relevance of a recent study on the country's budget.

Therefore, the digital newspaper Cubadebate published in its Friday edition a detailed examination of this vitally important issue.

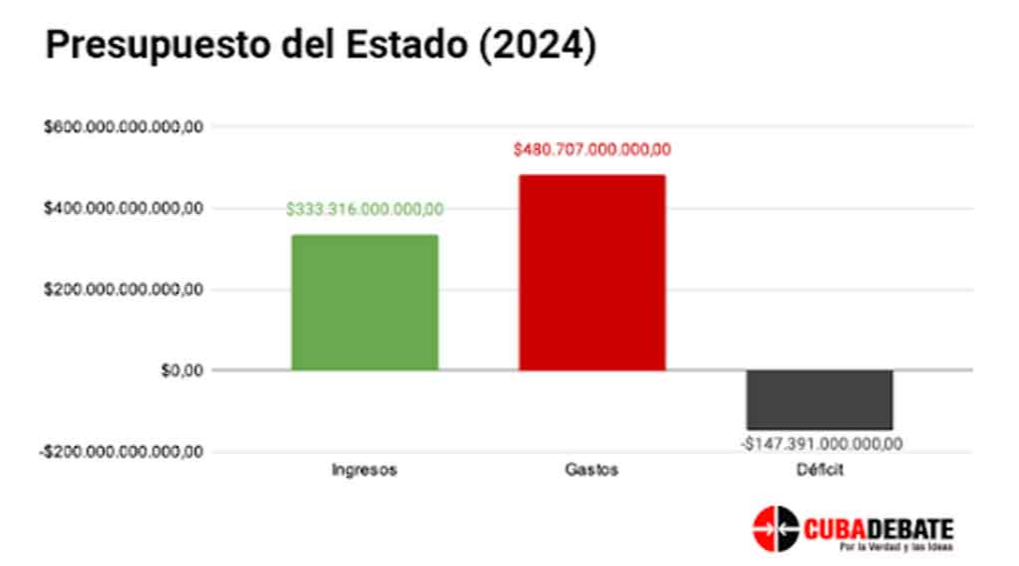

The newspaper points out that the reduction of the fiscal deficit in Cuba is an issue of vital importance for the country's economic and social development, an indicator that occurs when government expenditures exceed its revenues, which leads to an increase in public debt and a series of negative repercussions in the long term.

Moreover, its reduction would also contribute to the country's macroeconomic stability. A lower deficit would imply a decrease in the need for financing through debt issuance.

Cubadebate reports that according to the Minister of Finance and Prices, Vladimir Regueiro Ale, in the National Assembly of People's Power, the containment and reduction of the fiscal deficit are the immediate challenges for the performance of the state budget.

The 2024 State budget supports the objectives and goals considered in the plan for the economy, with priority given to satisfying the basic services of the population and advancing the recovery of economic activity in primary and strategic sectors.

Net revenues are projected at 333,316 million pesos (one Cuban peso is equivalent to 124 dollars at the official exchange rate in Cadeca), which is a minimum figure and finances only 69% of total expenditures, with an 88% participation of the state sector, which ratifies its fundamental role in the economy.

Tax revenues derived from the application of taxes, fees and contributions account for 64% of total revenues, reflecting a recovery of the tax system as an essential source of budgetary resources.

To achieve this, revenue levels are supported by the implementation of tax measures extended to 2024, which involve both state entities and new economic actors.Contributions from business profits are 22% of total revenues, with a 15% growth (72 thousand 756 million pesos), which ratifies the importance of business performance in the generation of budget revenues and the need to implement all measures to boost efficiency.

Meanwhile, contributions from non-state forms of management are projected in the order of 39 billion 172 million pesos, most of which are a source of revenue from municipal budgets, with a projected growth of 58% (14 billion 363 million pesos more).In the budget projection for 2024, local budgets are given special consideration in order to favor the financial autonomy of municipal and provincial budgets, the newspaper emphasizes.In this sense, it was decided to cede the collections from the tax on telecommunication services, which amount to approximately 2,600 million pesos, Regueiro Ale announced. He explained that, as a whole, the local budgets plan a negative result, amounting to 21,209 million pesos, improving with respect to the estimate for 2023 and marking a recovery trend compared to previous fiscal years.

Meanwhile, as measures to achieve tax growth, the authorities are considering the application of special taxes on the commercialization of a group of non-essential goods and services to the population, based on the increase of their sales prices, among them, cigars and tobacco.

In addition, the elimination of tax exemptions to non-state economic actors of 6 months and one year on the occasion of their incorporation and the extension of the application of the sales tax to all operations carried out by small and medium-sized companies (MSMEs).The amounts to be paid for the Land Transportation Tax are increased. Updating of the referential values of houses to apply the taxes associated to the sale and purchase of these goods between natural persons and regulation of their payment at the moment of formalizing the transfer.

The message recognizes the exchange rate of one dollar for 120 Cuban pesos (CUP) for the calculation of tariffs in import operations by non-state management.

In a long list of data, the document states that the social security budget covers 15% of the expenses of the budgeted activity. It grows by 3,75 billion pesos and supports the benefits of more than 1,824,000 retirees and pensioners (the maternity benefit is extended from 12 to 15 months).

Furthermore, the State budget for 2024 includes the protection through social assistance to 186,783 families and 339,754 beneficiaries in vulnerable situations, to which more than 6 billion pesos are allocated, the article refers.

The article concludes, after various information on the subject, by explaining that the execution of the housing program is supported by the allocation of approximately 5,196 million pesos.

For working capital, 4 thousand 690 million pesos are projected, of which 2 thousand million correspond to the commercial banks for the continuity of agricultural promotion and the sugar cane planting fund, and 1 thousand 267 million to the recovery of the industrial activity of nickel.

The sugar sector will receive 564 million pesos and agriculture 110 million pesos, while 650 million pesos will go to the National Electric Union and 99 million pesos to water and sanitation, the article concludes. (Source:Prensa Latina)