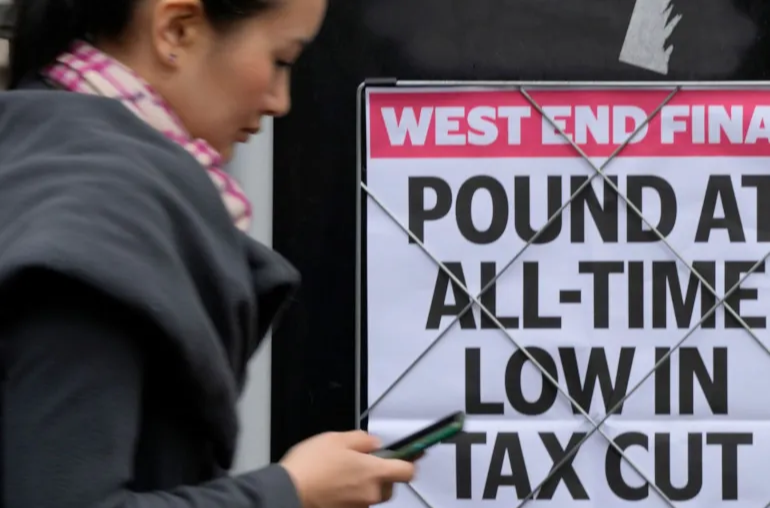

A woman walks past a headline posted on a wall announcing the Pound at an all time low

The IMF warned that the year ahead could "feel like a recession" [File: Frank Augstein/AP Photo]

Washington, October 12 (RHC)-- The International Monetary Fund (IMF) has cut its global growth forecast for 2023 as economic pressures collide, from the war in Ukraine, high energy and food prices, and sharply higher interest rates.

The IMF has warned that conditions could worsen significantly next year and said it expected more than a third of the world’s economy to contract. “The three largest economies – the United States, China and the euro area – will continue to stall,” IMF chief economist Pierre-Olivier Gourinchas said. “In short, the worst is yet to come, and for many people, 2023 will feel like a recession.”

In its World Economic Outlook the IMF said global GDP growth next year will slow to 2.7 percent, compared to a 2.9 percent forecast in July, as higher interest rates slow the United States economy, Europe struggles with spiking gas prices and China contends with continued COVID-19 lockdowns and a weakening property sector.

The fund is keeping its 2022 growth forecast at 3.2 percent, reflecting stronger-than-expected output in Europe but a weaker performance in the US after torrid 6 percent global growth in 2021. U.S. growth this year is forecast to be a meager 1.6 percent – a 0.7 percentage point downgrade from July. The drop reflects an unexpected second-quarter GDP contraction. The IMF kept its 2023 US growth forecast unchanged at 1 percent.

Eurozone growth will fall to 0.5 percent next year as high energy prices slam output, the IMF predicted, with some key economies, including Germany and Italy, entering technical recessions. Gourinchas said geopolitical shifts in the continent’s energy supplies will be “broad and permanent,” keeping prices high for a long time.

Regarding market turmoil in Britain after financial markets rebuked the new government’s proposed tax cuts, Gourinchas said UK fiscal policy needed to be in step with central bank inflation goals.

The global economy’s future health “rests critically” on the successful calibration of monetary policy, the course of the war in Ukraine and the possibility of further pandemic-related supply-side disruptions, the IMF said.

The economic future, it said, is subject to a delicate balancing act by central banks to fight inflation without overtightening, which could push the global economy into an “unnecessarily severe recession” and cause disruptions to financial markets and pain for developing countries. But it pointed squarely at controlling inflation as the bigger priority.

“The hard-won credibility of central banks could be undermined if they misjudge yet again the stubborn persistence of inflation,” Gourinchas said. “This would prove much more detrimental to future macroeconomic stability.” So far, however, price pressures are proving “quite stubborn and a major source of concern for policymakers”, the IMF said, adding while it expects global inflation to peak in late 2022 at 9.5 percent. It is forecast to “remain elevated for longer than previously expected”, decreasing to 4.1 percent by 2024.